![Finding Alpha on the Internet [Part 3]](/plots/internetAlpha/FinalGMM.png)

Finding Alpha on the Internet [Part 3]

We continue the series by replicating using as much data and code as provided in the source material. We create a three-state Gaussian Mixture Model and fit it so S&P500 data. I examine the output and give feedback about my coding replication and data sourcing along the way. Then I try to apply a proxy for adding economic data as a feature—previous posts Part 1 and Part 2.

![Finding Alpha on the Internet [Part 2]](/posts/covers/pexels-pixabay-256541.jpg)

Finding Alpha on the Internet [Part 2]

I was continuing from the last post. I will explain why I picked the paper I did, answer the questions from the previous post, and show my note-taking and thought process. After reading hundreds if not thousands of whitepapers, blogs, or articles, this is my distilled version of how I approach it. I will document this for the first time. It may be different from how others approach it. Over time you will get your own approach. So let’s hit the stacks.

Finding Alpha on the Internet Part 1

The internet is teeming with resources for potential alpha. How do you separate the wheat from the chaff? In this series of blog posts, I will explain my process for identifying sources worth diving deeper into and extracting some kind of benefit to a portfolio or strategy. This will be a side-by-side view of my workflow as an individual. As of now, I have no idea what even to research or how I will go about doing it. So let us begin.

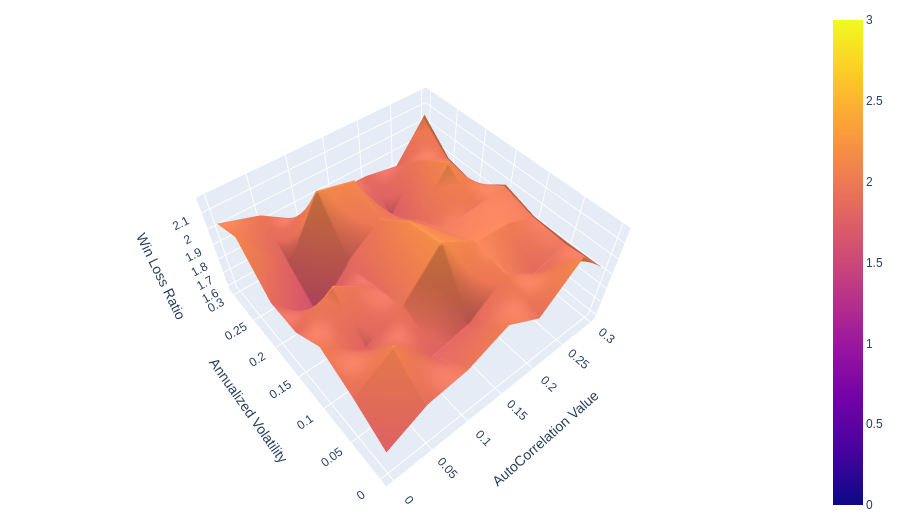

Trailing Stops in Various AutoCorrelation and Volatility Regimes

Abstract: I examine trailing stops in real markets and various autocorrelation and volatility regimes using synthetic data. Exits are notoriously under-studied and may be a source of edge. I examine three key hypotheses using my take on Tom Basso’s random entry method to remove entry from the equation.

Massive Passives Effect on Commodities

Introduction: “Massive Passive” has heavily influenced the equities sector, completely changing the dynamics of the stock market and the make-up of its participants. Now more people are getting exposure to commodities via long-only indexes and swap products. I am taking Irwin and Sanders’s paper The Impact of Index and Swap Funds on Commodity Futures Markets and extending it.

Not financial advice, no recommendations, only my own opinions. Nothing here constitutes a view or opinion from my employer. Please don’t sue me.

Any content or statement on this website is not to encourage nor promote taking any trades, positions, or investments of any kind. Any information contained in this website is for informational purposes only and to be taken as is. DWongResearch and the Author (Derek Wong) has done their best to ensure accurate information. Regardless of anything contrary, nothing available on this website should be understood as a recommendation, consult a licensed financial professional in your jurisdiction.

Intellectual property

I cannot and will not disclose any proprietary information or knowledge developed while working at my current employer or former employers. All research is done on my own and does not constitute any of my employers opinions. Anything you see here is done with publiclally available knowledge or the product of my own personal research done as a private individual.

I am an alternatives portfolio manager focused on quantitatve and systematic methods using derivatives. Quantitative finance geek, macroeconomics enthusiast, and research addict.